Why Your California Auto Insurance Rates Keep Climbing (Even With a Clean Record)

Let me guess – you just opened your auto insurance renewal, saw the new premium, and immediately questioned whether you accidentally added a Ferrari to your policy. Nope, that's just California in 2025.

You haven't filed a claim in years. Your driving record is cleaner than a Michelin-star kitchen. You're basically the insurance company's dream customer. And yet here you are, staring at a bill that's 20%, 30%, sometimes 40% higher than last year.

I get this call almost daily. Usually it starts with "Zach, can you explain what the hell is going on?" And honestly? I'm glad they're asking, because the answer isn't what most people think.

Why Are California Auto Insurance Rates Increasing in 2025?

Here's the thing nobody wants to say out loud: your clean driving record doesn't matter as much as you think it does.

I know, I know – that sounds insane. You're doing everything right! But auto insurance is a shared risk pool, which means you're not just paying for your risk. You're helping cover everyone else's too. And right now, "everyone else" is costing insurance companies a fortune.

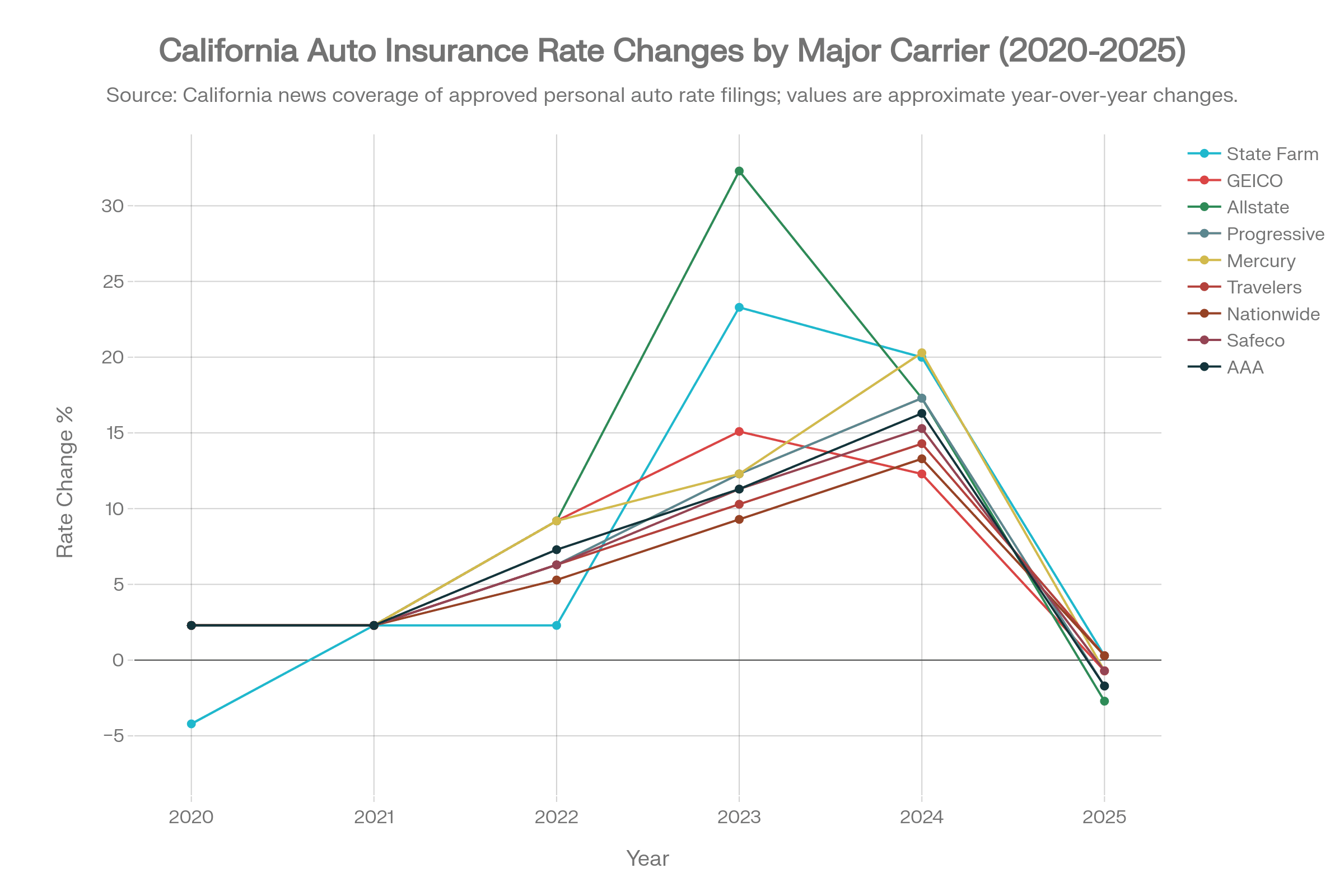

The numbers are brutal. State Farm got approval for a 20% rate increase in 2023. Allstate came back in 2024 asking for 34.1% – and got it. Mercury, CSAA, and basically every other carrier in California have filed for double-digit increases.

These aren't arbitrary numbers pulled from a hat. They're based on actual loss data. But here's the part that'll make your blood boil: a huge chunk of those losses has nothing to do with worse driving.

What's Really Driving California Auto Insurance Costs Up?

A few weeks ago I sat through a Travelers presentation that was basically a 90-minute confirmation of everything I've been telling Bay Area clients for the past two years: California's auto insurance market is broken, and the biggest culprit isn't what you'd expect.

It's not distracted drivers (though that's not helping).

It's not car thefts (though that's definitely a problem in SF).

It's not even the cost of fixing modern cars loaded with sensors and cameras (though, yeah, that's expensive too).

The real problem? Lawsuits.

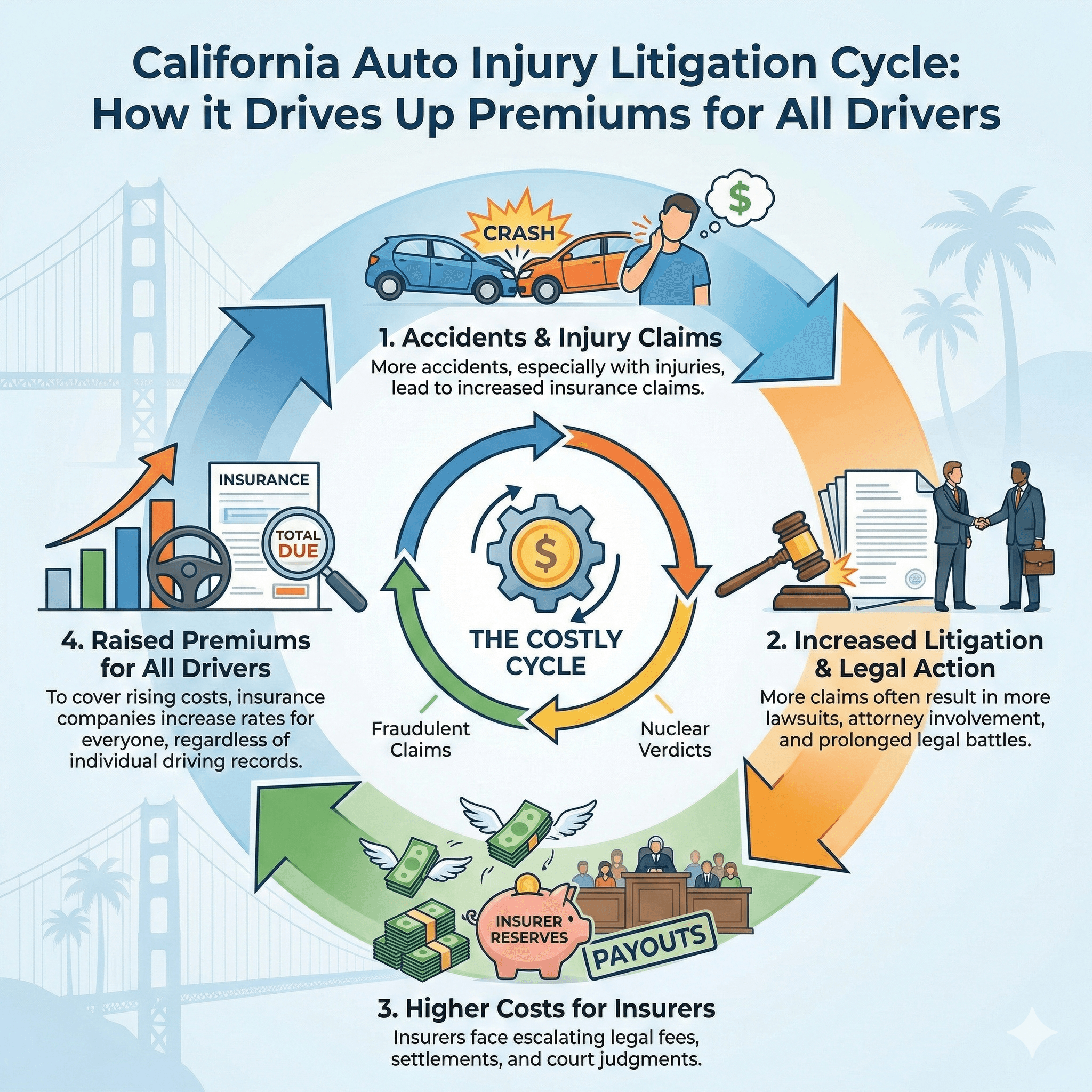

California has become the Wild West of auto injury litigation. What used to be straightforward claims – someone gets rear-ended, they see a doctor, insurance pays the bills, everyone moves on – have turned into multi-million dollar legal battles.

Social inflation is the industry term for it, but that sounds way too academic. Here's the plain English version: juries are awarding insane amounts of money for relatively minor accidents, and it's making everyone's insurance more expensive.

We're talking about verdicts that exceed $10 million for accidents where nobody died. Soft tissue injuries that used to settle for $15,000 are now going to trial and coming back with $2 million awards.

And because insurance is a shared pool, when one person gets a massive payout, everyone's premiums go up. The high tide raises all ships – even if your ship has been safely docked in the harbor for years.

Why Is California's Auto Insurance Litigation Problem So Bad?

If you live in the Bay Area, you've seen the billboards. Every bus bench. Every YouTube ad. Every Pandora interruption.

"Injured? You deserve millions! Call now!"

Our legal system has created a perfect storm:

I'm not saying people who are legitimately injured shouldn't be compensated – of course they should. But we've crossed a line where the system incentivizes litigation over resolution, and California drivers are paying the price.

Do We Need Tort Reform in California? (Yes. The Answer Is Yes.)

Okay, I'm getting on my soapbox now.

We desperately need tort reform in California.

I know that's not a popular opinion in progressive circles, and I'm not trying to make this political. But if you care about affordable auto insurance – and based on the calls I'm getting, you do – then we need to talk about this.

Our current system is a lawyer's paradise and a policyholder's nightmare. Every billboard, every bus bench, every spam text asking if you've been in an accident – those are all symptoms of a system that's completely off the rails.

Until we address the root cause – a legal framework that treats insurance companies like ATMs and encourages frivolous litigation – your rates will keep climbing. Better safety features, cleaner driving records, advanced crash avoidance technology... none of it matters if the legal system can just award unlimited damages for limited injuries.

Other states have implemented caps on non-economic damages. They've reformed attorney fee structures. They've created systems that actually prioritize getting injured people the care they need instead of maximizing settlement payouts.

California? We're going in the opposite direction.

How to Lower Your California Auto Insurance Costs (Without Sacrificing Protection)

Look, I'm not going to pretend there's a magic bullet that makes this problem disappear. But there are smart ways to manage your costs without leaving yourself exposed.

1. Increase Your Deductibles (Strategically)

Raising your comprehensive and collision deductibles from $500 to $1,000 can knock 15-20% off your premium. Just make sure you've got the cash to cover that higher out-of-pocket cost if you need to make a claim.

If you're driving a 2015 Honda Civic worth $8,000, maybe it's time to drop comprehensive and collision altogether and just carry liability. Put those savings in a "car replacement fund" instead.

2. Do NOT Lower Your Liability Limits

I cannot stress this enough: given everything I just told you about California's litigation environment, liability coverage is NOT the place to cut corners.

If anything, you should be increasing your liability limits. The state minimum of 15/30/5 is laughably inadequate. A serious accident could easily exceed those limits, and guess who's personally on the hook for the rest? You.

Consider 100/300/100 at minimum. Better yet, get an umbrella policy that sits on top of your auto and provides an extra $1-2 million in liability protection.

A few extra dollars a month now could be the difference between a financial setback and complete financial devastation.

3. Bundle Your Policies

Combining your auto with homeowners or renters insurance typically earns you a 15-25% discount with most carriers. It's one of the easiest ways to lower your premium without changing your coverage.

Plus, dealing with one agent for multiple policies is just... easier. When you need to file a claim or update coverage, you're not playing phone tree roulette with three different companies.

4. Actually Ask About Discounts

I know this sounds obvious, but you'd be surprised how many people are leaving money on the table:

5. Shop Around (But Shop Smart)

Yes, getting quotes from multiple carriers can help. But don't just chase the lowest price.

Make absolutely sure you're comparing apples to apples on coverage. A $200/month policy with 100/300/100 limits and a $500 deductible is not the same as a $150/month policy with 15/30/5 limits and a $2,000 deductible.

Also, check the carrier's financial strength and claims reputation. The cheapest policy doesn't mean much if the company fights you tooth and nail when you actually need to file a claim.

Should I Switch Auto Insurance Companies in California?

Maybe. But probably not as often as you think.

There's this myth that you should shop your auto insurance every six months to get the best rate. In reality, constantly switching carriers can backfire:

A better strategy? Review your coverage annually, but only switch if:

And if you're working with an independent agent like us at Nadler Insurance, we can shop multiple carriers for you without you having to lift a finger. That's kind of the whole point.

Frequently Asked Questions: California Auto Insurance Rate Increases

Why did my California auto insurance go up if I have a clean driving record?

Your clean record helps keep your rate lower than it would be otherwise, but it doesn't protect you from industry-wide increases. Auto insurance is a shared risk pool – when litigation costs, repair costs, and medical costs go up across California, carriers pass those expenses to all policyholders through rate increases.

What is social inflation in auto insurance?

Social inflation refers to rising insurance claim costs driven by increased litigation, larger jury awards, broader definitions of liability, and higher attorney involvement in claims. In California, this has led to multi-million dollar verdicts even for relatively minor accidents, which directly drives up premiums for everyone.

Can I lower my California auto insurance by reducing coverage?

You can, but you probably shouldn't. Lowering liability limits saves money short-term but exposes you to massive financial risk. Given California's litigation environment, carrying minimum liability coverage is a dangerous gamble. Instead, increase deductibles or drop comprehensive/collision on older vehicles.

Are California auto insurance rates higher than other states?

Yes and no. California's average auto insurance premium falls in the middle nationally, but Bay Area rates tend to run higher than the state average due to population density, traffic congestion, and higher repair costs. The bigger issue is the rate of increase – California has seen some of the steepest jumps in the past 3 years.

Will California auto insurance rates go down in 2025?

Unlikely. Insurance commissioners have approved significant rate increases through 2024, and carriers are still filing for more. Until California addresses the underlying litigation crisis and tort reform, expect rates to continue climbing. The best you can do is optimize your coverage and shop strategically.

The Bottom Line on California Auto Insurance Rate Increases

Your auto insurance rates are going up because the entire system is under pressure. Repair costs are higher. Medical expenses are higher. And most importantly, litigation costs are spiraling out of control.

Understanding why this is happening doesn't make the bill any easier to swallow, but it does help you make smarter decisions:

✅ Don't skimp on liability coverage

✅ Do increase deductibles strategically

✅ Do bundle policies for discounts

✅ Don't switch carriers every six months chasing pennies

✅ Do work with someone who can actually explain your options

If you're in the Bay Area and want to talk about your specific situation – whether you're with us or not – I'm happy to have a real conversation. Not a sales pitch. Just honest guidance about what makes sense for your situation.

Because at the end of the day, insurance should actually protect you when you need it. And if we can save you money in the process? Even better.